BestFitFinder is supported by its audience. When you purchase using link in our website, we may earn an affiliate commission. Learn more

You may want to read more about Monzo or Revolut before diving in to this comparison review, but if are ready please scroll down or select the topic that you are more interested in the menu above. Let’s get into it!

In the ever-growing world of fintech, Monzo and Revolut are two of the most popular challenger banks. But which one comes out on top? In this post, we’ll compare Monzo vs Revolut in a head-to-head battle to determine which app offers the best value and user experience. We’ll take a look at their fees, features, security, and overall user experience to help you decide which app is right for you.

Photo by Monzo

Photo by Revolut

Fees Monzo vs Revolut

Fees often serve as a crucial factor influencing user decisions. While they play a vital role in maintaining the operations and profitability of financial institutions, it’s essential to understand the fee structure of each option to make an informed choice. This becomes particularly pertinent when comparing two popular digital banking apps like Monzo and Revolut.

Monzo: A Seamless Fee Structure

Monzo’s pricing model is designed to cater to a wide range of users, offering a basic account with no monthly fees. For those who require additional features, Monzo Plus and Monzo Premium tiers are available, charging £5 and £15 per month, respectively. These premium plans unlock benefits such as overseas transaction fee reimbursements, travel insurance, and cashback rewards.

Revolut: Tiered Fees for Diverse Needs

Revolut’s fee structure adopts a tiered approach, with four different tiers offering varying levels of benefits and associated costs. The Standard account is free, while the Plus, Premium, and Metal tiers charge £5, £10, and £27 per month, respectively. These tiers provide features such as overseas transaction fee reimbursements, travel insurance, cryptocurrency trading, and airport lounge access.

Comparing Foreign Exchange Fees: A Global Perspective

Foreign exchange (FX) fees can significantly impact the overall cost of transactions when using digital banking apps abroad. Monzo offers competitive FX rates, charging a 0.35% fee on foreign currency transactions. Revolut’s FX fees are even lower, with a standard commission of 0.03%, making it an excellent option for frequent travelers.

ATM Withdrawals: Accessing Funds Wherever You Are

ATM withdrawals are an essential feature for managing finances on the go. Monzo and Revolut provide their standard account holders with a limited number of free ATM withdrawals per month. Monzo offers 20 free ATM withdrawals within the UK and Europe, while Revolut grants 10 free ATM withdrawals globally. For additional ATM withdrawals, Monzo charges £1.50 per transaction, while Revolut charges a variable fee based on the currency.

Understanding the Impact of Fees on Your Financial Decision

The fees associated with Monzo and Revolut can significantly impact your overall financial experience. For individuals who primarily use their accounts within the UK, Monzo’s free Standard account might suffice. However, for frequent travellers and those seeking additional features, the Monzo Plus or Premium tiers might be a better fit. Revolut’s tiered approach offers a wider range of options, catering to both basic and more demanding needs.

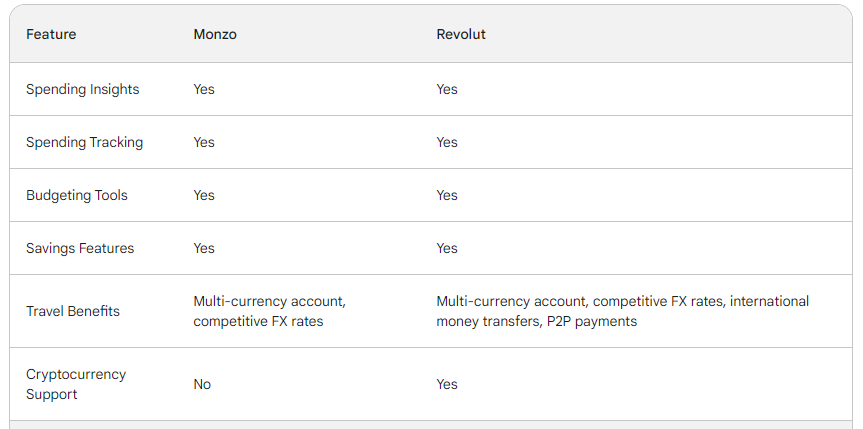

Feautures

These apps provide a range of features that cater to diverse needs, from budgeting and spending tracking to international money transfers and cryptocurrency trading.

Monzo: A Feature-Packed App for Everyday Needs

Monzo’s feature-rich offering encompasses a comprehensive suite of tools for everyday financial management. Its spending insights dashboard provides real-time visibility into spending patterns, allowing users to identify areas for improvement. Additionally, Monzo’s pots feature enables users to compartmentalize their finances, creating virtual savings accounts for specific goals or expenses.

Monzo’s Travel Benefits: Embracing Global Mobility

For frequent travelers, Monzo offers a suite of features that simplify managing finances abroad. With its multi-currency account, users can hold and exchange multiple currencies seamlessly, avoiding currency conversion fees. Monzo also provides competitive FX rates, ensuring that users get the most out of their money when making transactions in foreign currencies.

Revolut: A Multifaceted App for Global Financial Needs

Revolut’s feature set extends beyond everyday banking, catering to a wider range of financial needs. Its money transfer feature facilitates international transfers at competitive exchange rates, while its peer-to-peer (P2P) payments option enables instant and fee-free money transfers between Revolut users.

Revolut’s Cryptocurrency Offering: Embracing the Digital Revolution

Revolut stands out for its extensive cryptocurrency support, allowing users to buy, sell, and hold a variety of cryptocurrencies directly within the app. This feature makes it a compelling choice for those interested in exploring the world of digital assets.

Monzo and Revolut offer a compelling mix of features that cater to diverse financial needs. For those seeking a comprehensive solution for everyday banking and travel, Revolut’s feature set might be a better fit. However, for those primarily focused on budgeting and spending insights, Monzo could be a more suitable choice.

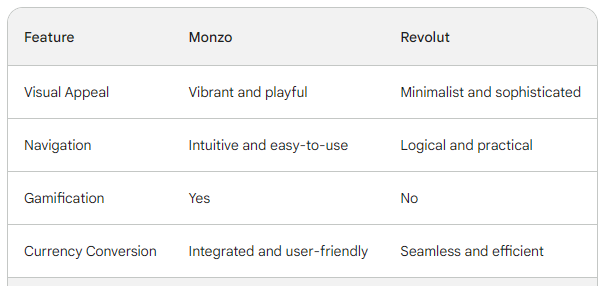

A User-Friendly Approach

A seamless and intuitive interface can make managing finances a breeze, while a complex and cluttered design can lead to frustration and hinder user engagement. Monzo and Revolut, both prominent players in the digital banking landscape, have developed their apps with a focus on user-friendliness, striving to provide a seamless and enjoyable experience for their customers.

Photo by Liza Summer

Monzo: A Charismatic and Engaging User Interface

Monzo’s user interface is designed to be both visually appealing and highly functional. The app’s color palette, featuring vibrant hues and a playful design, sets a cheerful tone and makes the experience engaging. Additionally, Monzo’s intuitive layout and easy-to-navigate menu structure make it effortless to perform various banking tasks, from checking balances to transferring funds.

Monzo’s Gamification: Enhancing User Engagement

Monzo employs gamification elements to enhance user engagement and encourage financial responsibility. The app rewards users for saving money by unlocking virtual pots and badges, transforming financial management into an enjoyable experience. This gamified approach has proven to be effective in motivating users to manage their finances more effectively.

Revolut: A Functional and Packed Interface

Revolut’s user interface prioritizes functionality over aesthetics, providing a clean and straightforward design that focuses on the core banking tasks. The app’s color palette is minimalist, with a focus on white and dark gray tones, creating a professional and sophisticated look. Revolut’s menu structure is logical and easy to understand, enabling users to navigate the app efficiently.

Revolut’s Currency Converter: A User-Friendly Feature

Revolut’s currency converter is a prime example of the app’s user-friendly design. The converter is seamlessly integrated into the app’s interface, providing real-time exchange rates for a wide range of currencies. The converter’s intuitive design makes it easy to compare rates and conduct currency conversions, making it a valuable tool for frequent travelers or those dealing with international transactions.

Both Monzo and Revolut have invested heavily in developing user-friendly interfaces that cater to the needs of their customers. Monzo’s approach focuses on gamification and a charismatic design, while Revolut prioritizes functionality and a minimalist aesthetic. Ultimately, the choice between the two depends on individual preferences and the type of user experience that resonates most.

Understanding Customer Bases: A Comparative Analysis of Monzo and Revolut

Customer base plays a significant role in determining the overall success of an app. A broad and engaged customer base can provide valuable insights, fuel innovation, and drive market expansion. Monzo and Revolut, two prominent players in this space, have attracted a diverse and loyal customer base, reflecting their unique offerings and appeal to different demographics.

| Monzo: A Focus on the UK and Young Individuals Monzo’s customer base is primarily concentrated in the United Kingdom, with a significant majority of users under the age of 35. This demographic reflects Monzo’s focus on providing a user-friendly and innovative banking experience for the tech-savvy generation. Monzo’s app-based approach and gamified elements resonate particularly well with this group. | Revolut: A Global Reach and Diverse User Base Revolut’s customer base is more geographically diverse, with a substantial presence in Europe and emerging markets. The app’s comprehensive feature set, including international money transfers and cryptocurrency trading, appeals to a wider range of users, including business travelers, entrepreneurs, and investors. Revolut’s multilingual support further expands its global reach. |

The customer bases of Monzo and Revolut reflect their unique strengths and target audiences. Monzo’s focus on the UK and young individuals has been instrumental in its success within this specific market segment. Revolut’s global reach and diverse feature set have attracted a broader customer base, catering to a wider range of financial needs and preferences.

Unveiling Additional Categories for Comparing Monzo and Revolut

Several additional categories can provide valuable insights into the strengths and weaknesses of each app, enabling a more nuanced understanding of their offerings.

Cryptocurrency Support: Embracing the Digital Revolution

Cryptocurrency has emerged as a transformative force in the financial landscape, and digital banking apps are increasingly incorporating support for digital assets. Monzo currently offers limited cryptocurrency support, allowing users to buy and sell a handful of cryptocurrencies directly within the app. Revolut, on the other hand, provides a more comprehensive cryptocurrency offering, including a wider range of supported currencies, trading features, and even staking opportunities.

Photo by Worldspectrum

Investment Features: Expanding Horizons for Financial Goals

While traditional banking primarily focuses on transactional activities, digital banking apps are venturing into the realm of investment, allowing users to manage their investments directly within the app. Monzo offers a range of investment options, including stocks and ETFs, through partner platforms. Revolut, however, provides more direct investment capabilities, allowing users to buy and sell stocks, ETFs, and even cryptocurrencies directly within the app.

Travel Features: Simplifying Financial Management Abroad

For frequent travelers, digital banking apps can streamline financial management while abroad. Monzo offers multi-currency accounts, competitive FX rates, and travel insurance to enhance the travel experience. Revolut, on the other hand, goes a step further, providing fee-free international money transfers, peer-to-peer payments in multiple currencies, and even airport lounge access for select premium tiers.

Business Solutions: Catering to the Needs of Enterprises

Digital banking apps have expanded their reach to cater to the specific needs of businesses. Monzo offers a business banking account with features such as dedicated support, invoice management, and expense tracking. Revolut also provides business banking solutions, including multi-user access, advanced reporting, and dedicated customer support.

Photo by pranjal srivastava

Accessibility Features for People with Disabilities

Digital banking apps have an increasing focus on accessibility, ensuring that their services are inclusive and accessible to all. Monzo adheres to WCAG (Web Content Accessibility Guidelines) standards, making the app usable by individuals with visual, auditory, and motor impairments. Revolut also prioritizes accessibility, offering features such as screen reader compatibility and voice recognition.

Conclusion: A Comprehensive Approach for Informed Decision-Making

By considering these additional categories, users can gain a more comprehensive understanding of Monzo and Revolut, enabling them to make an informed decision based on their specific needs and financial goals. Whether seeking a seamless travel companion, a platform for managing investments, or simply a user-friendly everyday banking app, these additional comparisons can guide users towards the option that best suits their financial life.

In the dynamic realm of digital banking, Monzo and Revolut have emerged as leading contenders, offering a compelling combination of features, user experience, and value. By carefully comparing their fee structures, features, user experiences, customer bases, and additional categories, users can make an informed decision about which app best suits their financial needs and aspirations. Whether seeking a user-friendly everyday banking app, a comprehensive travel companion, or a platform for managing investments, Monzo and Revolut provide versatile solutions to cater to diverse financial lifestyles. By embracing the digital banking revolution, individuals can take control of their finances, simplify their banking journeys, and achieve their financial goals with ease and convenience.